Bank Failures Trigger Lending Pullback

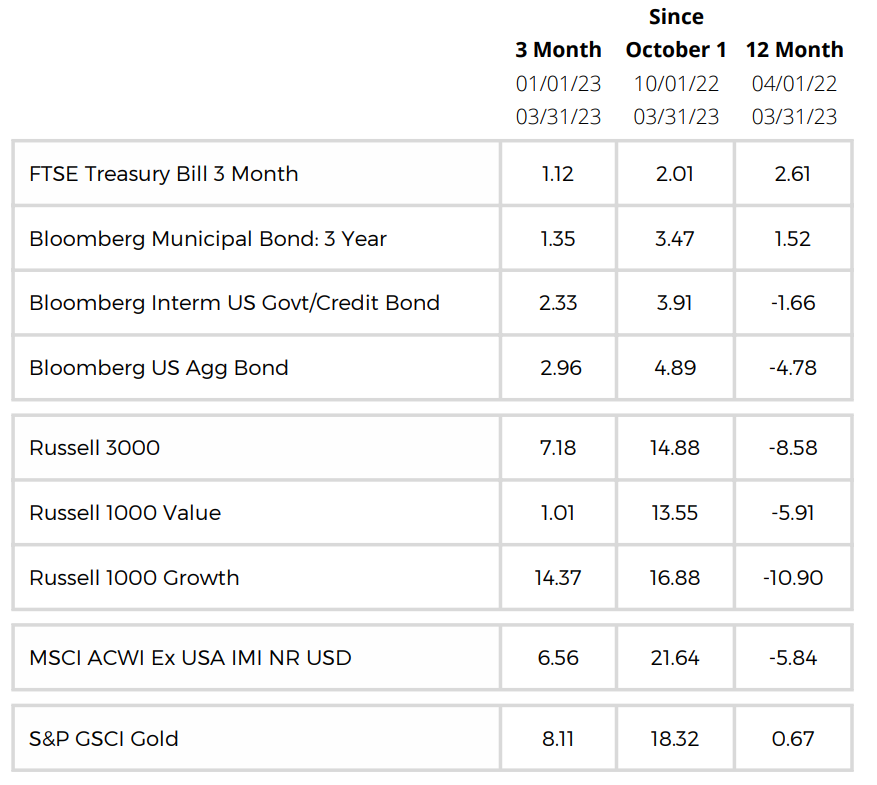

Following a challenging 2022, markets rebounded during the first quarter of 2023. Domestic equities rallied 7.2% and non-U.S. equities earned 6.6%. Bond returns were positive for the quarter, as taxable bonds and municipal bonds gained 2.3% and 1.4%, respectively.

Since the October 2022 market lows, U.S. equities have gained 14.9%, international equities have earned 21.6% and the price of gold has risen 18.3%.

Bank Failures Trigger Lending Pullback

The big story during the first quarter was the failure of two notable banks—Silicon Valley/Signature (and First Republic Bank on April 29th) —and the potential impact on the banking industry and the overall economy. Fears of another Great Recession scenario shook investors’ confidence, but those fears have subsided following the Fed’s response and implementing of the Bank Term Financing Program (BTFP).

While this program has helped ease investor concerns, unrealized losses on bank balance sheets and deposit outflows from regional banks may negatively impact the economy by limiting the access and availability to credit. Should it materialize, a lending pullback increases the likelihood of a recession in the second half of 2023.

Despite the first-quarter equity rally, our outlook remains cautious. The Federal Reserve’s aggressive tightening cycle is beginning to have economic repercussions. Continued residential real estate investment declines, tepid loan growth, an uptick in bond defaults, declining consumer sentiment, and a cooling labor market all point to a tough road ahead.

In our view, the near-term economic headwinds appear stronger than the tailwinds and, as a result, we have reduced the credit risk in the fixed income segment of client portfolios. In addition, we extended the duration to the take advantage of the yields on longer-dated maturities and enhance portfolio diversification in the event of a recession.

Our views can be summarized as follows:

After a tough year in 2022, we expect stronger fixed income returns in 2023.

We maintain a quality bias in the domestic equity segment of client portfolios, as we expect below-average returns until macroeconomic and earnings data improve.

Non-U.S. equity valuations are compelling -- we continue to look for opportunities to increase this exposure in client portfolios.

Slowing Inflation Gives Bonds a Boost

The Fed is making progress in its fight against inflation. As supply shortages abate, demand weakens, and wage inflation normalizes, inflationary pressures and near-term expectations continue to decline.

Latest data point is Mar 2023

Sources: Clearnomics, Bureau of Labor Statistics

© 2023 Clearnomics, Inc.

CPI is a commonly cited measure of inflation. It uses a basket of goods and services to track price changes for consumers.

In order to measure the underlying trend in inflation, rather than temporary shocks to food and energy, economists often focus on core CPI.

Inflation has been cooling but services inflation remains problematic due to shelter costs.

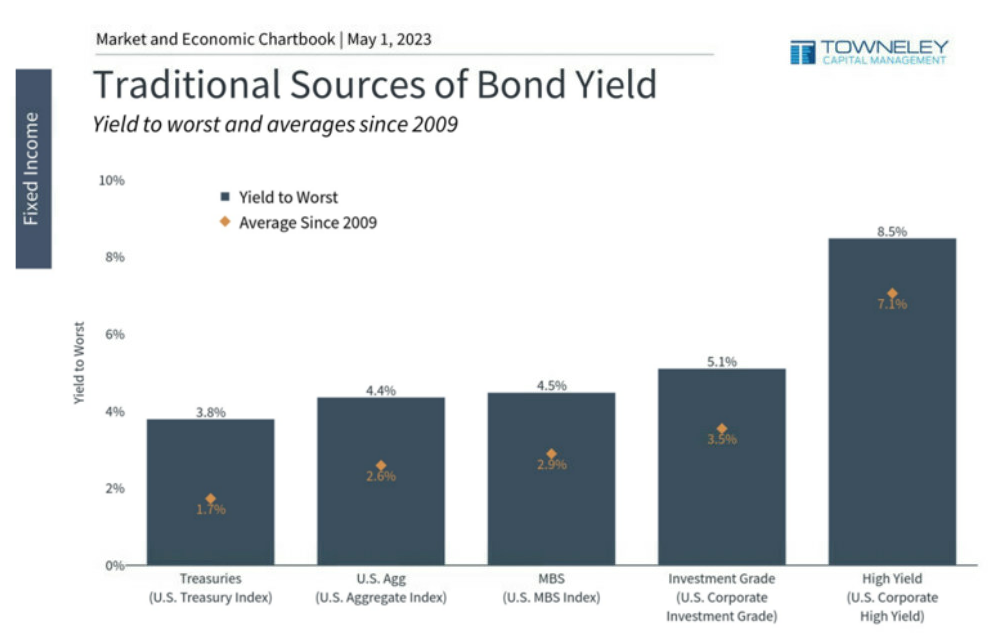

Lessening inflationary pressure should dampen the interest rate volatility we’ve experienced over the past 18 months and provide a favorable environment for fixed-income returns. Following 13 years of zero interest rate policy (ZIRP), the current climate offers compelling yields relative to the last decade.

The following chart compares yield to worst (YTW) to the average yield of various segments of the fixed income market. YTW measures the worst-case yield scenario for a bond, accounting for the fact it may be called before maturity. As a result, YTW is a more conservative and thus a more preferred measure of potential bond yields than yield to maturity. As of March 31, 2023, worst case bond yields exceeded 13-year average yields in all bond categories.

Latest data point is Apr 28, 2023

Sources: Clearnomics, Bloomberg

© 2023 Clearnomics, Inc.

Bond yields can act as a necessary balance to volatile equities in portfolios.

Yield-to-worst shows the lowest possible yield of a bond operating within its contract if the bond does default.

Yields across bond indices are elevated well above their average since 2009 following recent interest rate increases.

The calendar year 2022 marked the 3rd year in the past 100 when stocks and bonds declined; 1931 and 1969 were the other two. However, bond returns were positive the following year and outperformed equities in both cases. For example, the following chart indicates that bonds returned 8.5% in 1932 and 18.9% in 1970, while equities returned -8.8% and 4.0%, respectively.

Although nothing is certain, slowing inflation and normalizing interest rates suggests 2023 could be a good year for the bond market.

Fed Policy, Banking, and the Economy

The banking turmoil in March created an unusual situation for the Fed. In response to solvency concerns in the sector, the Fed launched the Bank Term Financing Program (BTFP), allowing banks to post Agency, Treasury, and Mortgage-Backed Securities as collateral to borrow at the Fed’s discount window. This successful program has enabled banks to satisfy client withdrawal requests without selling bonds at a loss.

While the program effectively controlled contagion risk within the banking sector, it altered the Fed’s path toward quantitative tightening. For example, before the launch of BTFP, the Fed’s balance sheet was in steady decline. However, the balance sheet reversed course and grew by $400 billion in March as banks accessed the BTFP window. Such an increase, amid an aggressive tightening cycle, is akin to pushing the gas and brake pedals simultaneously and has made the Fed’s inflation fight more challenging.

Recent lending data suggests that small and regional banks are issuing fewer loans. Since these banks rely more heavily on deposits to make loans, the pullback in lending is not surprising. However, these institutions play a significant role in the economy and a pullback in lending activity can negatively impact GDP. For perspective, regional banks account for approximately 50% of industrial lending, 60% of residential real estate lending, 80% of commercial lending, and 45% of consumer lending.

Macroeconomic data, including leading economic indicators, consumer sentiment, and global economic activity, point to a sharp slowdown ahead. As a result, a recession appears likely in the second half of 2023. Further, we expect the Fed will have difficulty navigating a soft landing if it occurs.

Forward-Looking Valuations Favor Non-U.S. Equities

While U.S. equities outperformed non-U.S. equities over the past 15 years, the spread between forward-looking valuations, as measured by price/earnings ratios, suggests non-U.S. equities are significantly more attractive. Currently, non-U.S. equities trade at a 30% discount to U.S. equities, as measured by weighted average price/earnings ratios. We are planning to increase international equity relative to domestic equity in client portfolios during the second quarter.

Latest data point is Apr 4, 2023

Sources: Clearnomics, Standard & Poor’s, MSCI, Refinitiv

© 2023 Clearnomics, Inc.

Valuations for different regions have taken similar trajectories over the past 20 years, but at different levels.

The U.S. has been the most expensive since 2008 due to its strong stock market performance.

Throughout this time, there have been periods of opportunity for all markets, especially emerging ones.

With the forward P/E ratio of U.S. equities above 18x and year-over-year corporate earnings expected to decline 6.5%, we question the sustainability of the current stock market rally. Moreover, while some are optimistic that earnings will rebound during the second half of 2023 and support higher equity returns, this is unlikely, given the potential for a recession and six consecutive quarters of profit margin declines for S&P 500 companies.

Conclusion

Despite our near-term cautionary stance, we urge our clients to continue to ignore the short-term noise, stay the course, and focus on their longer-term goals. Discipline, diversification, and appropriate asset allocation are critical components of long-term investment success. Maintaining your diversified portfolio in the face of less than encouraging economic and financial news enables it to reap the benefit of positive market moves. Please contact your portfolio manager if your cash flow, goals, or needs have changed so that we can evaluate whether readjusting your asset allocation makes sense.